EO for Accountants

Three reasons why Employee Ownership trusts are worth your attention

Your clients make significant tax savings

You get to look good in the eyes of your clients as a sale of >50% shareholding to an Employee Ownership Trust incurs 0% CGT (assuming HMRC compliance).

A meaningful value-add for your clients

Clients will be familiar with a trade sale and MBO, but many will appreciate a route that allows passing on their legacy and protecting the future employment of their people.

You keep your clients post-deal

Unlike a trade sale, you get to keep your clients post-deal.

Webinar for accountants and business brokers

Want to find out more about employee ownership for clients?

A 40-minute webinar will provide you and your colleagues with the key financial and legal aspects of an employee ownership deal.

What’s in it for you?

Tax Benefits

Tax reliefs introduced in Finance Act 2014 relating to companies owned by Employee Ownership Trusts gave the following:

Full Capital Gains Tax relief for company owners who sell >50% shares to an EOT.

Exemption from income tax for bonuses of up to £3,600 per employee per year paid on an “all employees” basis.

Inheritance tax reliefs on certain transfers into and out of an EOT.

Financial Aspects of EO Transition

If you’re wondering how business valuations are being calculated in light of Covid19, James Shand of vfdnet clarifies and explains the main financial aspects of an EO deal.

Key Legal Features of EO Trusts

Robert Postlethwaite of Postlethwaite Employee Ownership Lawyers explains the key legal features of selling employees via an Employee Ownership Trust.

What is EO and how does it work?

Robert Postlethwaite of Postlethwaite Solicitors explains the fundamentals of Employee Ownership.

Free Business Exit Audit

When a client faced with exiting their business approaches you, an MBO or trade sale may be the right option. But if leaving their legacy and protecting their employees is important, an Employee Ownership Trust with the CGT saving may be the best route.

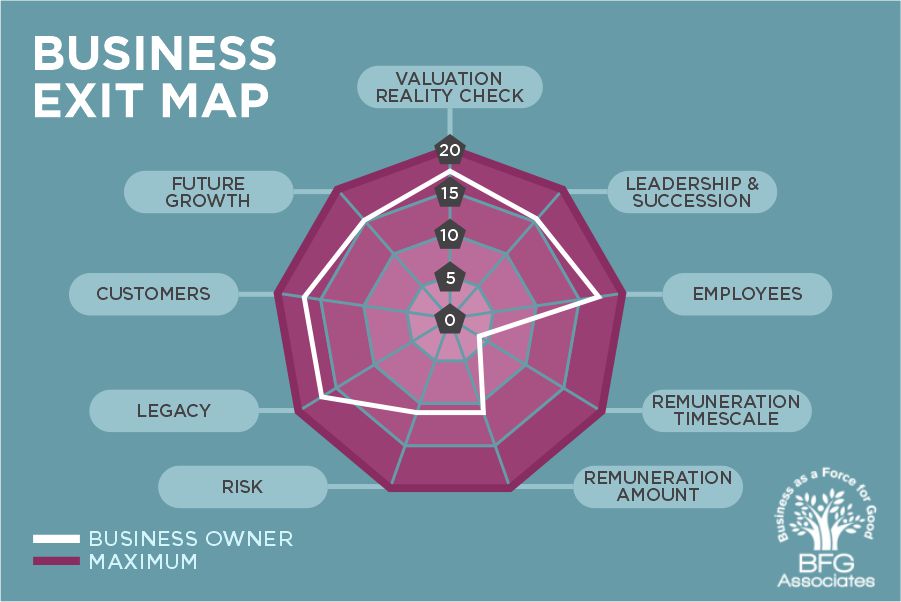

Having successfully sold our business to our 70 employees, I offer a free consultation using the ReadiMap® Business Exit Audit which enables your client to decide on the ownership structure that is right for them and their business.

To book a free session, call or email [email protected]