Business as a force for good

Employee Ownership

Benefits

Enhanced Business Performance

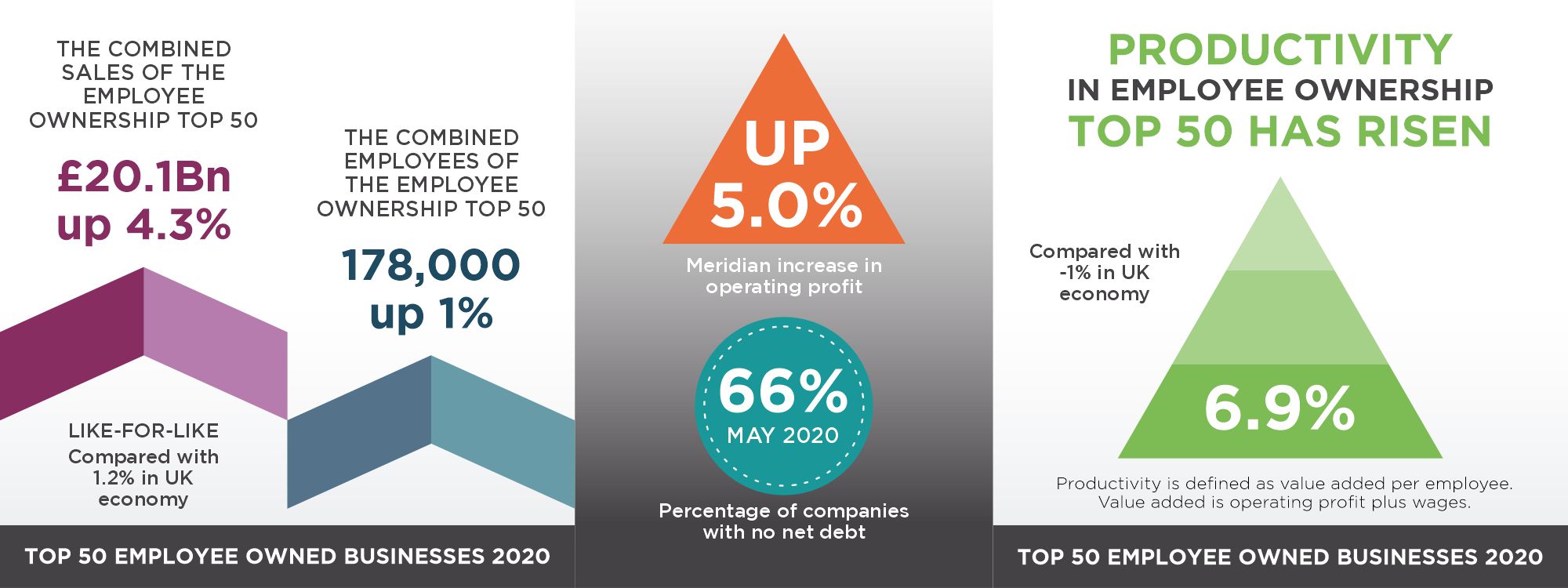

Research indicates that shared ownership delivers superior business performance and provides resilience when times are tough, as employees tend to be more motivated and committed to the company and its success. In a 2020 report by Leeds University and RM2 on the top 50 employee-owned businesses combined sales were up 4.7% compared with 1.2% in UK economy, and productivity was up 6.9% compared with -1% in UK economy. There was a 2.5% increase in operating profit and 66% of businesses in the top 50 had no debt. business sale and a realistic time frame. Read more on the BFG Associates process.

Meaningful Employee Engagement

With so many employees now working from home, employee engagement is not only desirable but essential, as the output and performance of your people is increasingly difficult to monitor and measure. Those who are poorly motivated or disgruntled will simply not deliver what the business needs. In a study on employee-owned businesses, 80% experienced a sense of achievement from their jobs and the same number were happy to recommend their organisation as a place to work.

Protecting your employees and leaving your legacy

Unlike a trade sale or take-over, you are ensuring the continued livelihood of employees, and with an Employee Ownership Trust, you can set out the main principles of how you want the business to be run in the future. We laid down our 3 Guiding Principles of Values-led culture, innovation and long-term sustainability in the Trust Deed. These are the non-negotiable building blocks of the business to which the Board of Directors are held accountable.

Tax Benefits

Tax reliefs introduced in Finance Act 2014 relating to companies owned by Employee Ownership Trusts gave the following:

Full Capital Gains Tax relief for company owners who sell >50% shares to an EOT.

Exemption from income tax for bonuses of up to £3,600 per employee per year paid on an “all employees” basis.

Inheritance tax reliefs on certain transfers into and out of an EOT.